Ssa 1724 Printable Form

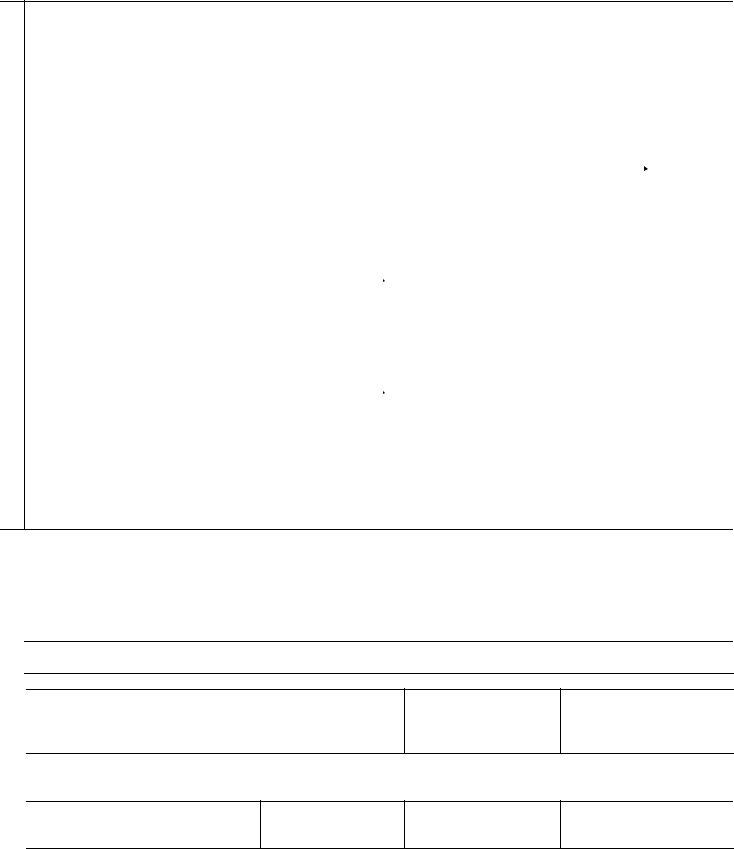

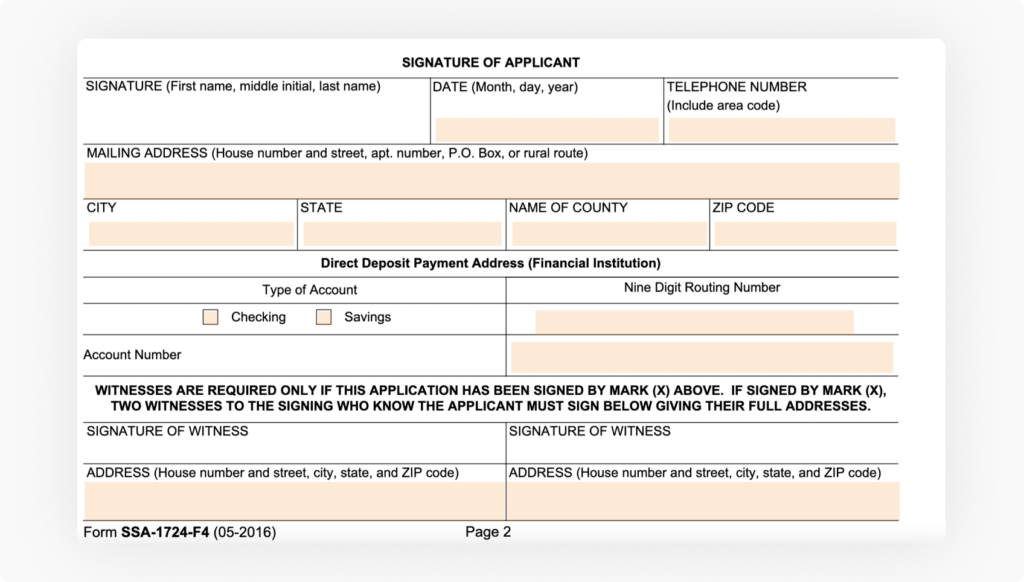

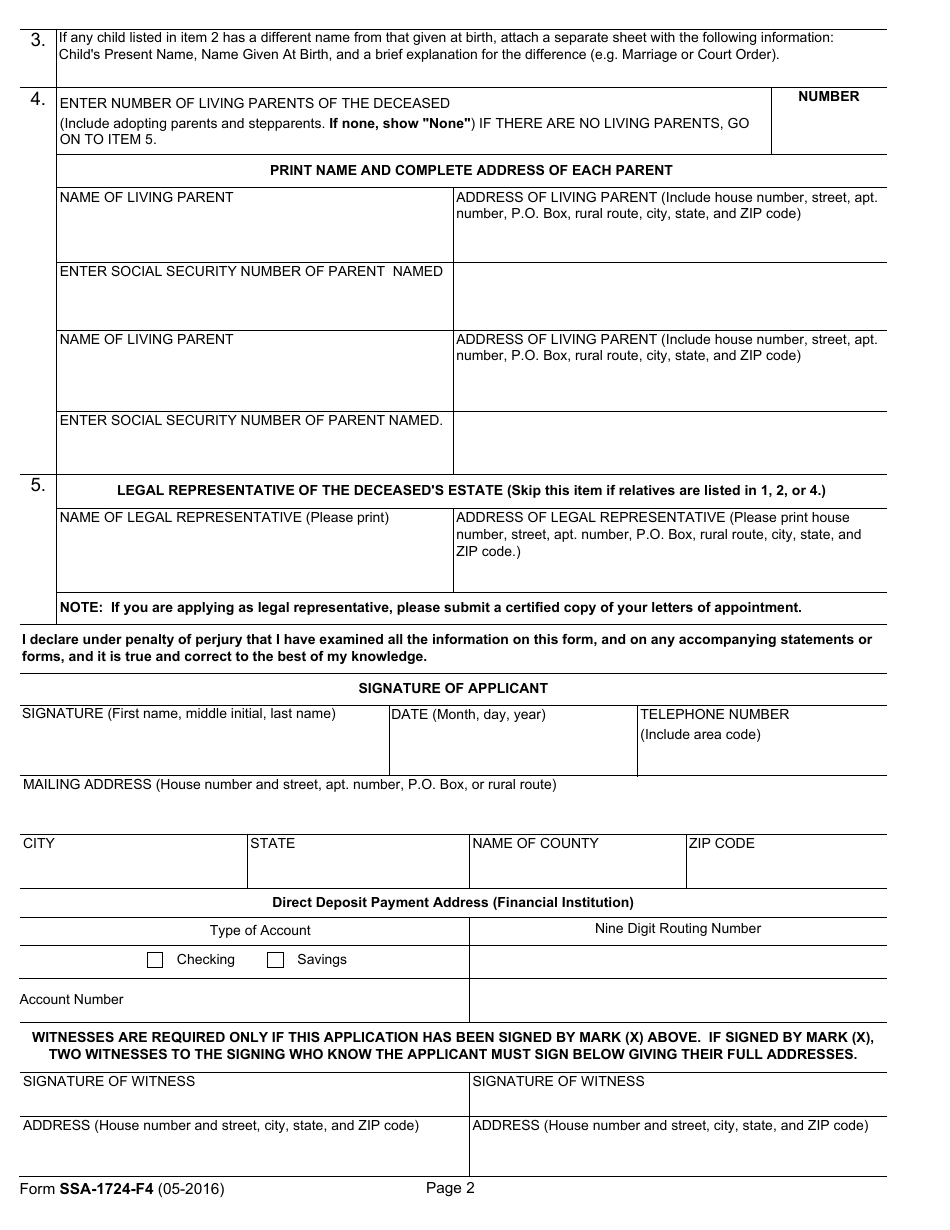

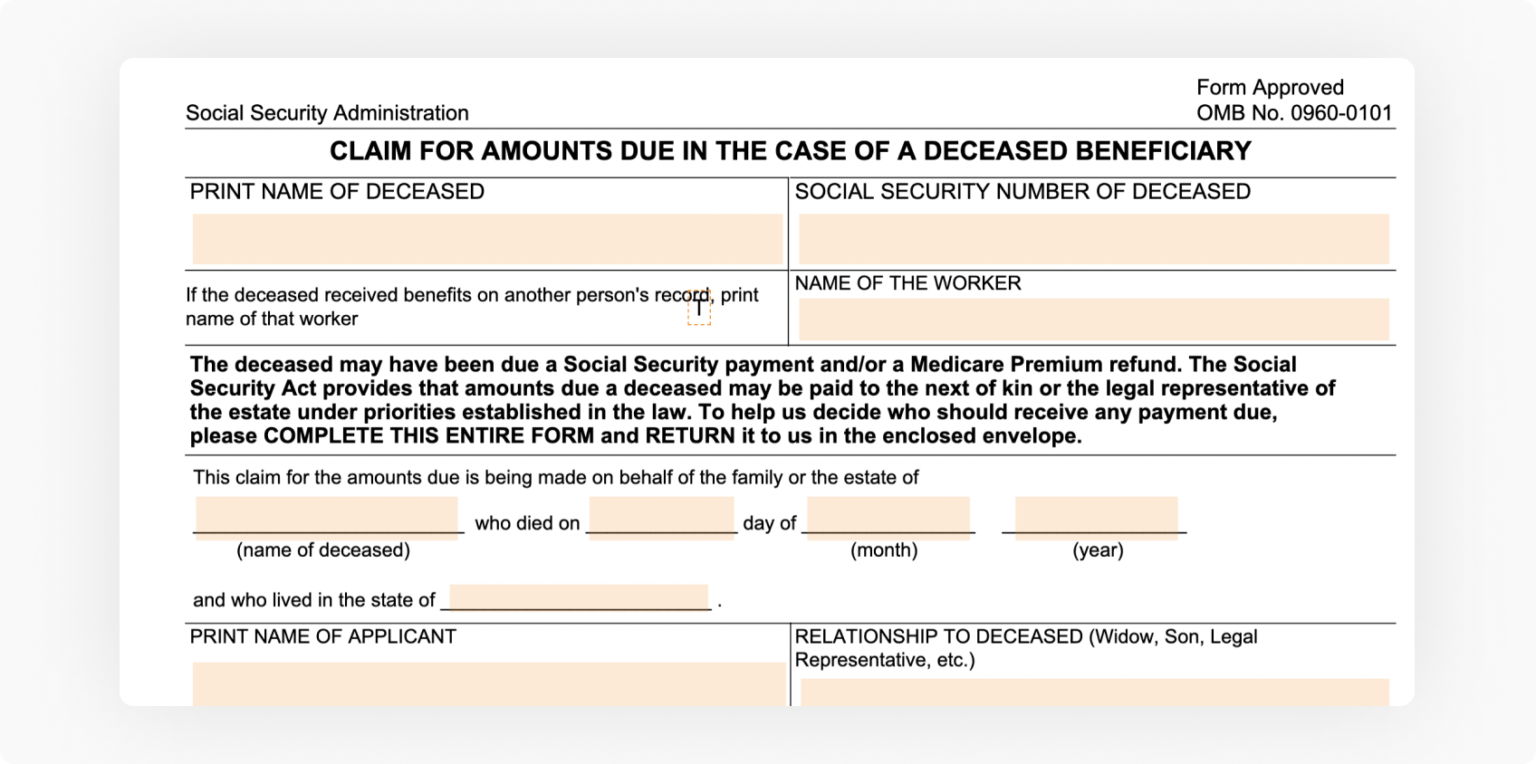

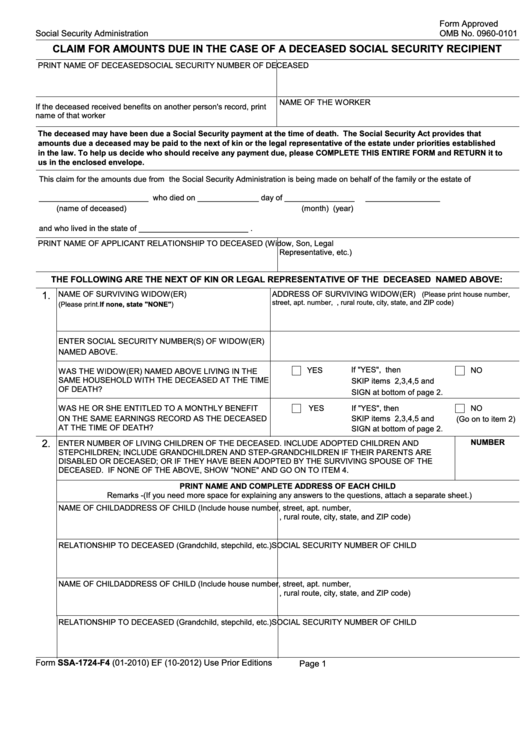

Ssa 1724 Printable Form - We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. Web the deceased may have been due a social security payment at the time of death. 4 ssa form 1724 templates are collected for any of your needs. The social security act provides that amounts due a deceased may be paid to the next of kin or the legal representative of the estate under priorities established in the law. Web the deceased may have been due a social security payment and/or a medicare premium refund. Where to send this form. I need help completing the form for claiming amounts due in the case of a deceased beneficiary. If you download, print and complete a paper form, please mail or take it to your local social security office or the office that requested it from you. Please complete this form to help us decide who should receive any payment due. The social security act provides that amounts due a deceased may be paid to the next of kin or the legal representative of the estate under priorities established in the law. Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. Web the deceased may have been due a social security payment and/or a medicare premium refund. Please complete this form to help us decide who should. 4 ssa form 1724 templates are collected for any of your needs. The social security act provides that amounts due a deceased may be paid to the next of kin or the legal representative of the estate under priorities established in the law. Please complete this form to help us decide who should receive any payment due. Web a deceased. Generally, it is the individual's legal next of kin who completes this form. Web the deceased may have been due a social security payment at the time of death. Send the completed form to your local social security office. 4 ssa form 1724 templates are collected for any of your needs. Web a deceased beneficiary may have been due a. 4 ssa form 1724 templates are collected for any of your needs. Web a deceased beneficiary may have been due a social security payment at the time of death. Web the deceased may have been due a social security payment at the time of death. Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary,. I need help completing the form for claiming amounts due in the case of a deceased beneficiary. 4 ssa form 1724 templates are collected for any of your needs. Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent. Web the deceased may have been due a social security payment and/or a medicare premium refund. The social security act provides that amounts due a deceased may be paid to the next of kin or the legal representative of the estate under priorities established in the law. Web the deceased may have been due a social security payment at the. The social security act provides that amounts due a deceased may be paid to the next of kin or the legal representative of the estate under priorities established in the law. If you download, print and complete a paper form, please mail or take it to your local social security office or the office that requested it from you. Web. The social security act provides that amounts due a deceased may be paid to the next of kin or the legal representative of the estate under priorities established in the law. I need help completing the form for claiming amounts due in the case of a deceased beneficiary. Please complete this form to help us decide who should receive any. Generally, it is the individual's legal next of kin who completes this form. Where to send this form. The social security act provides that amounts due a deceased may be paid to the next of kin or the legal representative of the estate under priorities established in the law. If you download, print and complete a paper form, please mail. Send the completed form to your local social security office. The social security act provides that amounts due a deceased may be paid to the next of kin or the legal representative of the estate under priorities established in the law. The social security act provides that amounts due a deceased may be paid to the next of kin or. If you download, print and complete a paper form, please mail or take it to your local social security office or the office that requested it from you. Please complete this form to help us decide who should receive any payment due. Where to send this form. Web the deceased may have been due a social security payment at the time of death. We may pay amounts due a deceased beneficiary to a family member or legal representative of the estate. Web form ssa 1724, claim for amounts due in the case of a deceased beneficiary, is a form used to claim a social security payment that was owed to the decedent before their death. 4 ssa form 1724 templates are collected for any of your needs. Send the completed form to your local social security office. Generally, it is the individual's legal next of kin who completes this form. I need help completing the form for claiming amounts due in the case of a deceased beneficiary. The social security act provides that amounts due a deceased may be paid to the next of kin or the legal representative of the estate under priorities established in the law.

SSA1724F4 Instructions pdfFiller Blog

Form SSA1724F4 Fill Out, Sign Online and Download Fillable PDF

Fillable Online jklo Ssa Form 1724 PDF 401309ef0b79c04ed07128195a51e13b

SSA1724F4 Instructions pdfFiller Blog

Ssa 1724 Printable Form prntbl.concejomunicipaldechinu.gov.co

Ssa 1724 Printable Form Printable Word Searches

Ssa 1724 Printable Form Printable Forms Free Online

Ssa 1724 Printable Form prntbl.concejomunicipaldechinu.gov.co

Ssa 1724 Printable Form

Form SSA 1724 Instructions Claims On Behalf of a Decedent

Web The Deceased May Have Been Due A Social Security Payment And/Or A Medicare Premium Refund.

The Social Security Act Provides That Amounts Due A Deceased May Be Paid To The Next Of Kin Or The Legal Representative Of The Estate Under Priorities Established In The Law.

Web A Deceased Beneficiary May Have Been Due A Social Security Payment At The Time Of Death.

Related Post: