Printable Tax Deduction Cheat Sheet

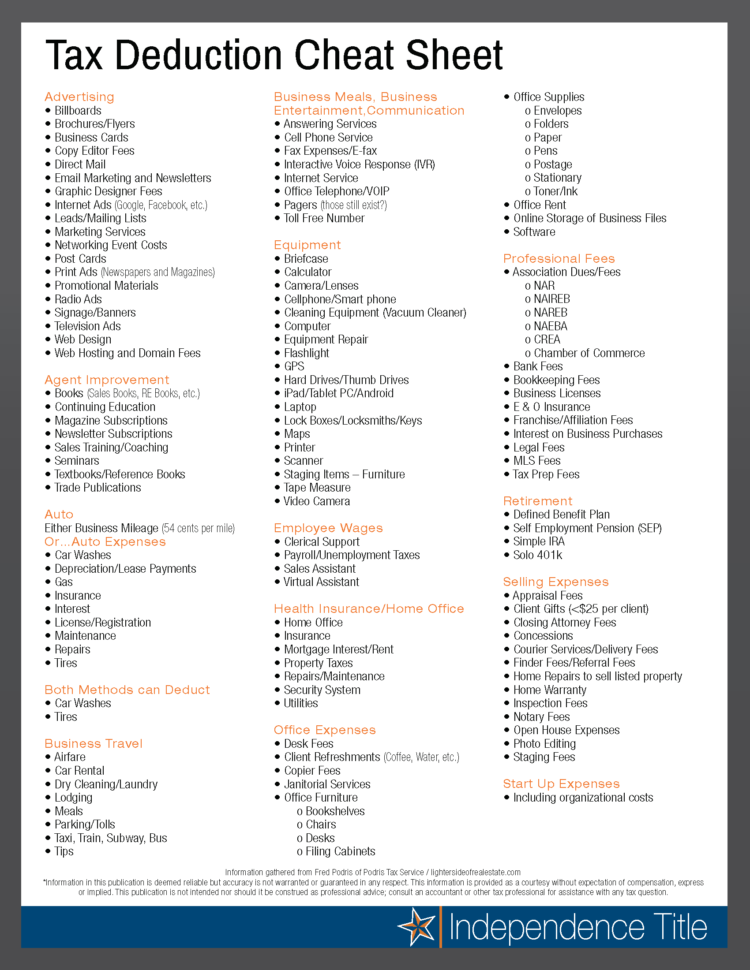

Printable Tax Deduction Cheat Sheet - Included on this cheat sheet is meant as an outline only. Web for the 2022 year, you can deduct 100% of business meals when talking shop with employees, but keep your receipts. Web let’s break down these distinctions: According to fundera, on average, the effective small business tax rate is 19.8%, adding that sole proprietorships pay a 13.3% tax rate and small partnerships pay a 23.6% tax rate. I can tell you from first hand experience that working for yourself can offer a boatload of gratifying rewards. Web such a cheat sheet is exactly what’s below, thanks to two folks: Advertising —> deduct it using: Advertising and marketing costs are 100% deductible. Explore book buy on amazon. If your startup costs are more than $50,000 in year one, your deduction will be reduced by the amount above the limit that you paid. Advertising —> deduct it using: $19,400 for heads of the household. If you’re eligible for a $2,000 tax credit, that’s $2,000 less you owe to the government. Please always confirm all deductions with your c. Web for this reason, irs has devised a simplified method. Click the links below to find details on the different tax deductions you can take depending on your unique setup. I can tell you from first hand experience that working for yourself can offer a boatload of gratifying rewards. Advertising and marketing costs are 100% deductible. $19,400 for heads of the household. Please always confirm all deductions with your c. Let’s say you drive 1,200 business miles this year. The way the reimbursement works is that you multiply your total annual business mileage by the standard rate. Web below is your tax deduction cheat sheet for 2024. I can tell you from first hand experience that working for yourself can offer a boatload of gratifying rewards. Advertising costs include the. Advertising and marketing costs are 100% deductible. Please always confirm all deductions with your c. $25,900 for surviving spouses or married couples who are filing jointly. Click the links below to find details on the different tax deductions you can take depending on your unique setup. Have documentation for your deductions and. Advertising and marketing costs are 100% deductible. Assuming your effective tax rate is 20%, that $5,000 tax deduction. Web if your costs are $50,000 or less in the first year, your deduction is capped at $5,000. Despite the cap, many freelancers find value in the simplified method. Web let’s break down these distinctions: Love them or hate them (okay, no one loves paying them!), everyone has to deal with them. Web for this reason, irs has devised a simplified method. Then download and email this tax write off cheat sheet to your bookkeeper or accountant. In fact, if you work from home like i do, there is no doubt that you enjoy your. Don’t forget to grab your downloadable and printable tax deduction cheat sheet here: In fact, if you work from home like i do, there is no doubt that you enjoy your extra short. This way, at a glance you can see where you are and what you need to do. Click the links below to find details on the different. 1) fred podris of podris tax service who compiled the list, and realtor® brenda douglas who kindly posted it to facebook for all to benefit from. $19,400 for heads of the household. The 2023 tax deduction cheat sheet for business owners. Have the social security numbers and dates of birth for you, your spouse, and your dependents at hand before. Total business mileage x standard mileage rate = tax deduction. 1) fred podris of podris tax service who compiled the list, and realtor® brenda douglas who kindly posted it to facebook for all to benefit from. Assuming your effective tax rate is 20%, that $5,000 tax deduction. $25,900 for surviving spouses or married couples who are filing jointly. Taxes are. The result is your tax deduction. A or tax professional as the laws may change at any. According to fundera, on average, the effective small business tax rate is 19.8%, adding that sole proprietorships pay a 13.3% tax rate and small partnerships pay a 23.6% tax rate. There are several types of deductions that business owners can leverage for their. Despite the cap, many freelancers find value in the simplified method. Web let’s break down these distinctions: Explore book buy on amazon. Assuming your effective tax rate is 20%, that $5,000 tax deduction. Web if you are paying for 2022 standard deduction, it applies as follows: The way the reimbursement works is that you multiply your total annual business mileage by the standard rate. 2024 edition cheat sheet is here to help guide you through tax challenges with some straightforward strategies. Don’t forget to grab your downloadable and printable tax deduction cheat sheet here: Advertising —> deduct it using: In 2022, business meals were 100% deductible when conducting business meetings at a restaurant with employees. A or tax professional as the laws may change at any. The 2023 tax deduction cheat sheet for business owners. The result is your tax deduction. I can tell you from first hand experience that working for yourself can offer a boatload of gratifying rewards. There are several types of deductions that business owners can leverage for their taxes. Total business mileage x standard mileage rate = tax deduction.

Printable Tax Deduction Cheat Sheet

Printable Tax Deduction Cheat Sheet

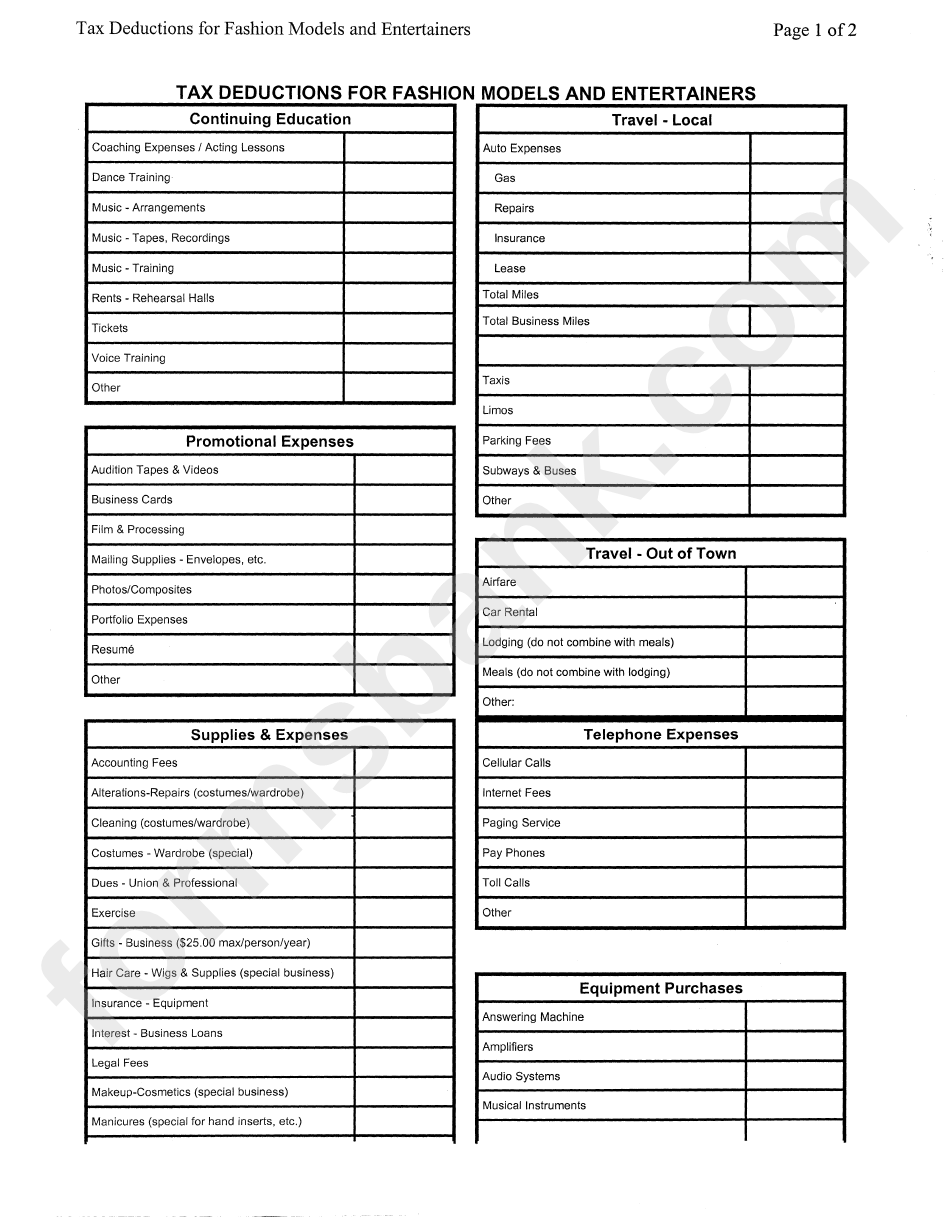

The Epic Cheatsheet to Deductions for the SelfEmployed Small

Printable Tax Deduction Cheat Sheet

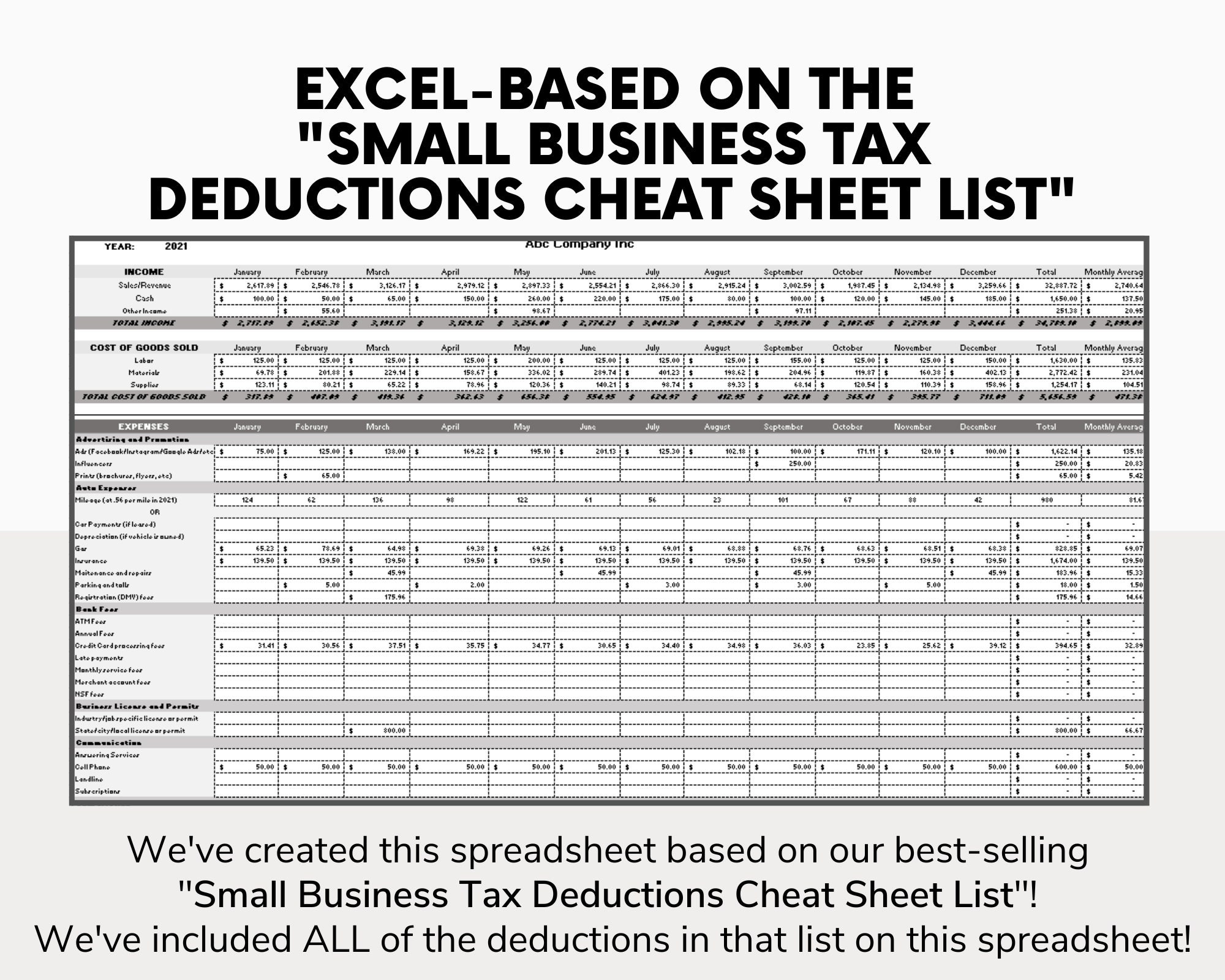

Business Tax Deductions Cheat Sheet Excel in Grey Deductible Tax Write

Printable Tax Deduction Cheat Sheet

Printable Tax Deduction Cheat Sheet

Tax Deduction Cheat Sheet For Real Estate Agents —

Printable Tax Deduction Cheat Sheet

StartUp CheatSheet 10 Tax Deductions You Must Know — Pioneer

Web Such A Cheat Sheet Is Exactly What’s Below, Thanks To Two Folks:

After The First Year, You Can Amortize The Remaining Expenses Over The Next 15 Years.

This Way, At A Glance You Can See Where You Are And What You Need To Do.

Then Download And Email This Tax Write Off Cheat Sheet To Your Bookkeeper Or Accountant.

Related Post: