Printable Donation Receipt

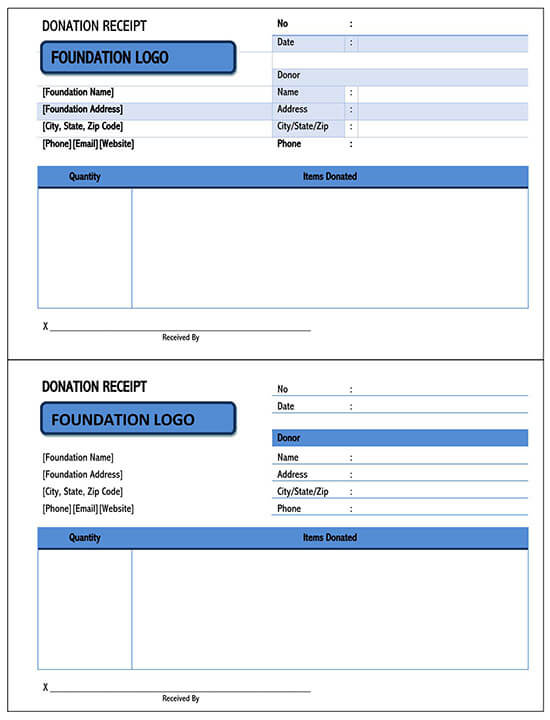

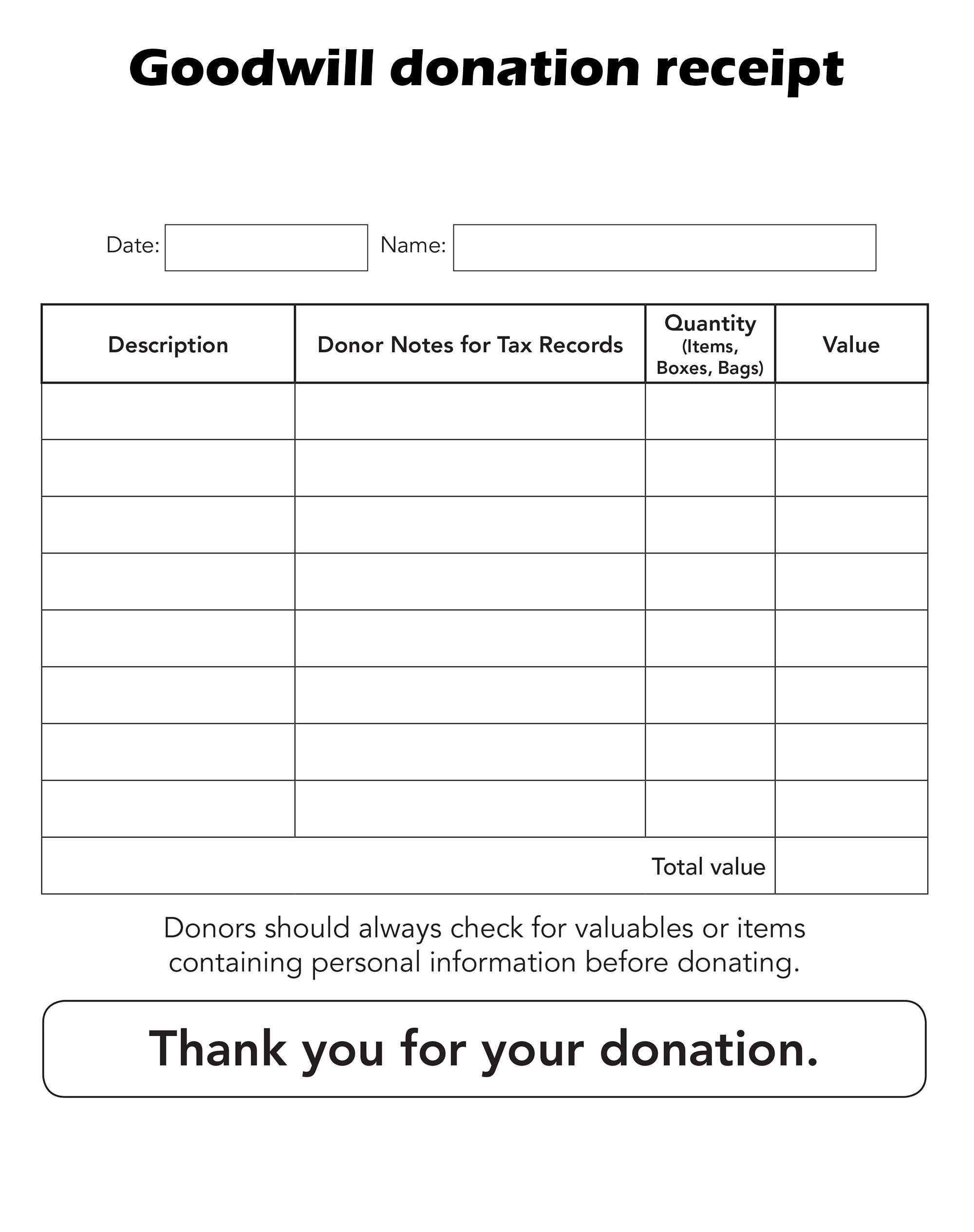

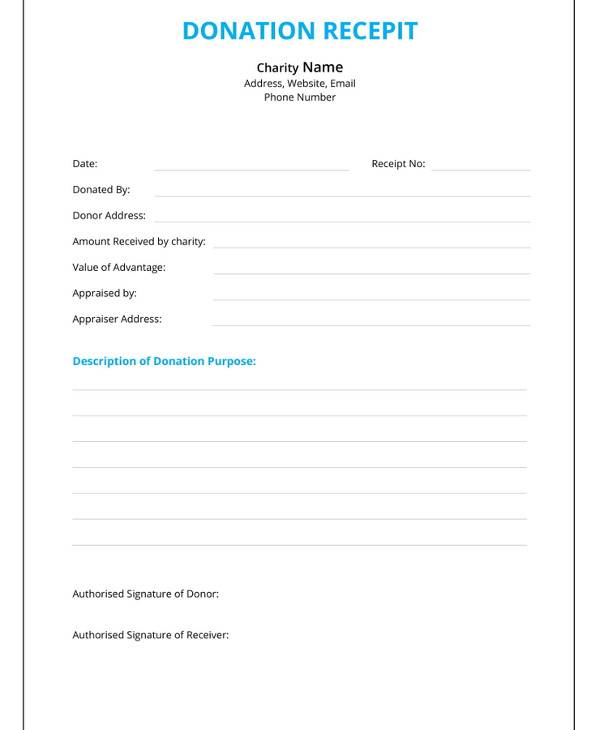

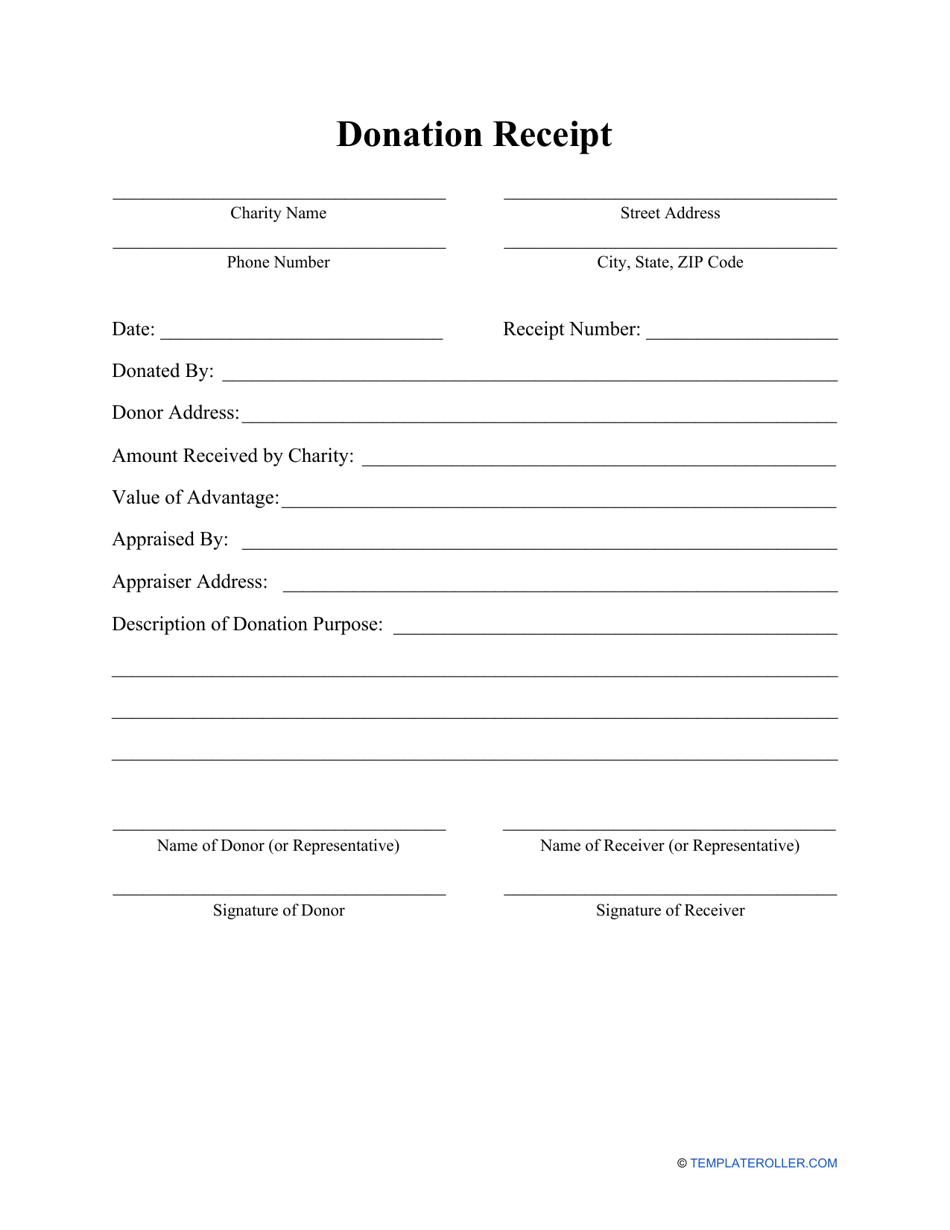

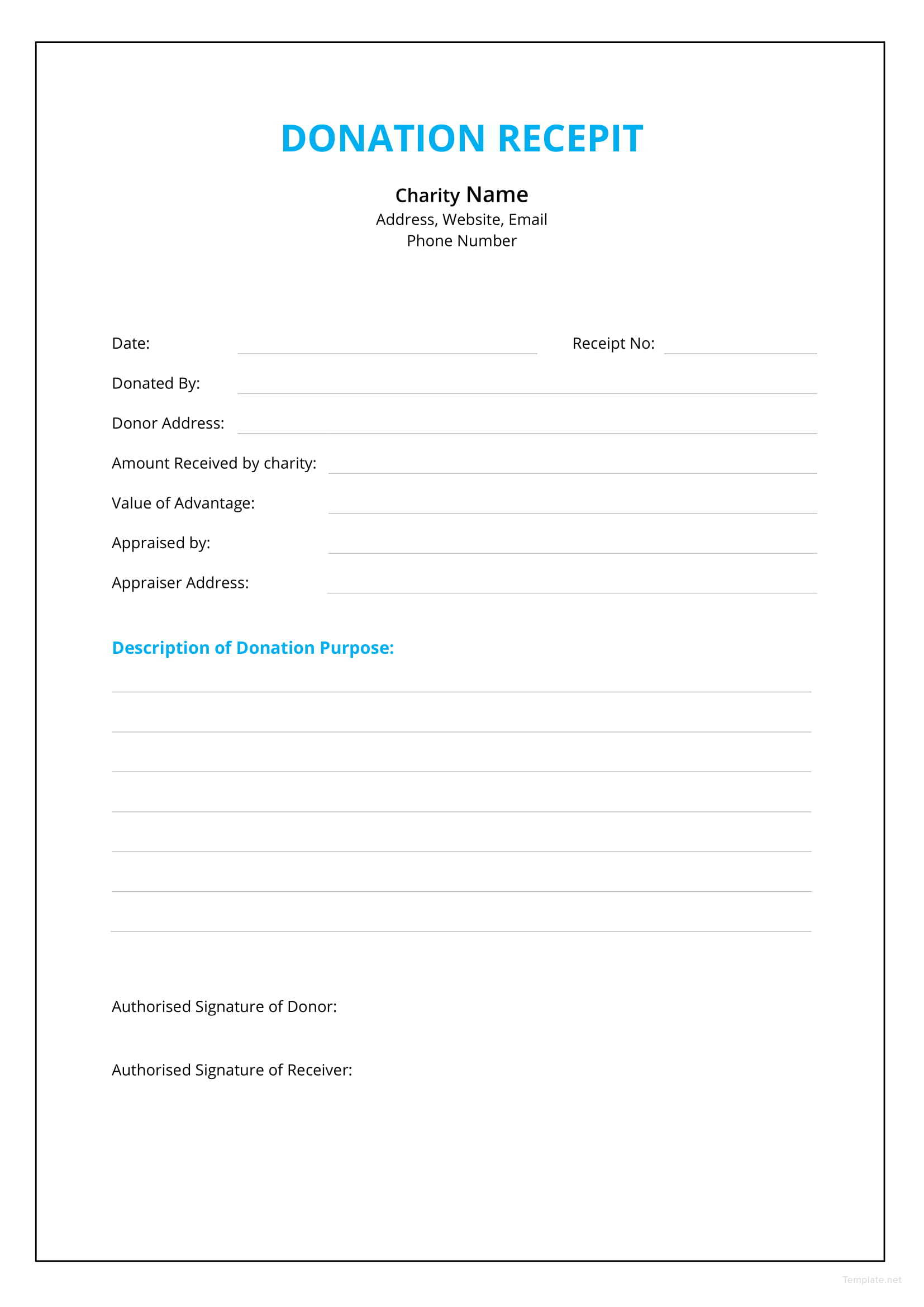

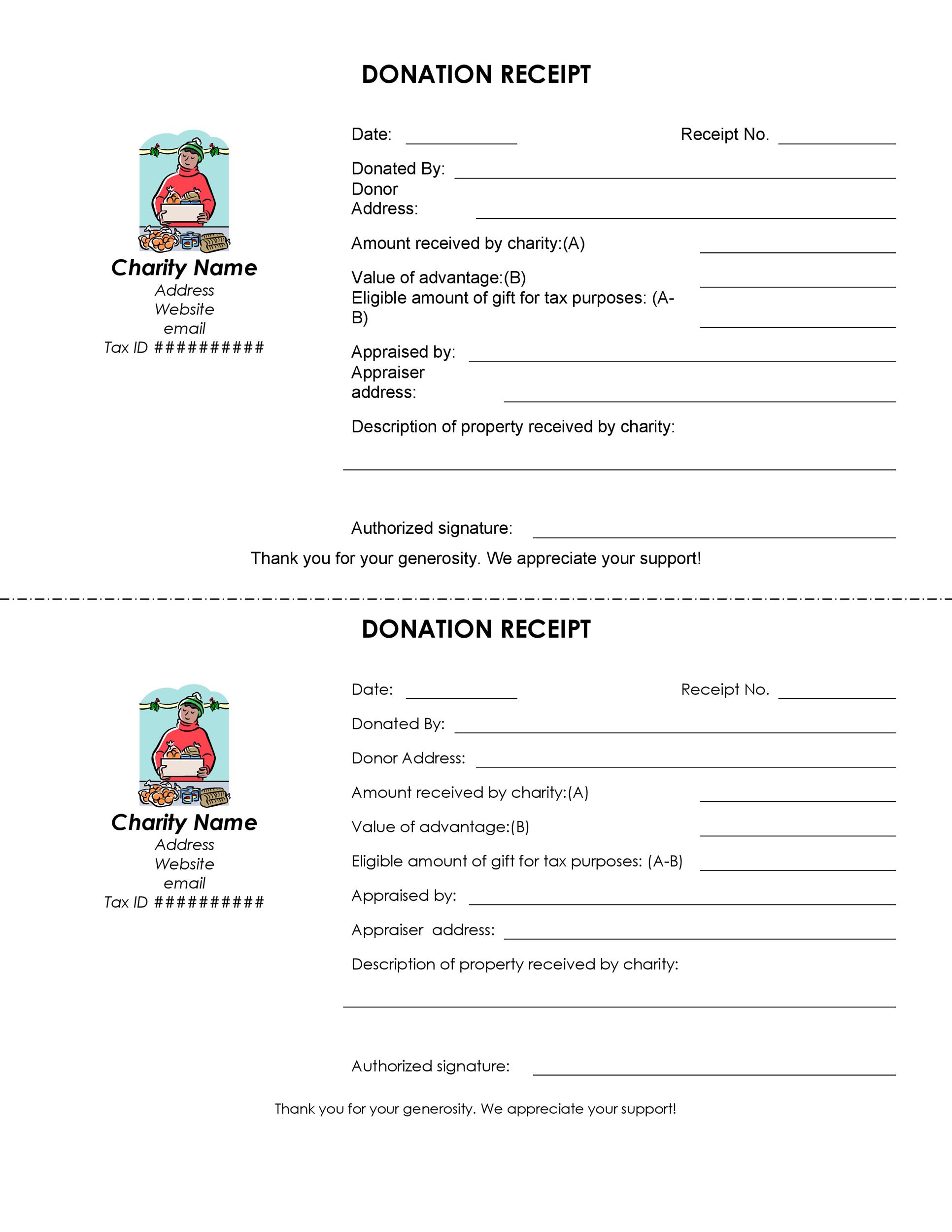

Printable Donation Receipt - Instead of creating from scratch, you can get and use these donation receipt templates for free. How to create donation receipts (plus, real examples!) use givebutter’s free donation receipt templates for. The “other” section can be used to describe items that are not clothing, household or furniture. One requirement is that you give donors a donation receipt, also known as a 501 (c) (3). Web this donations receipt template provides official documentation and information regarding the gift or money made by a donor. Web a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. These free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. If you are responsible for creating a document like this for your organization, these charitable donation receipt templates make it easy to acknowledge gifts from your donors in a variety of situations. Web a donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. Web a donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area. Here’s our collection of donation receipt templates. If you’re using sumac nonprofit crm, you can setup your receipts to send automatically after someone makes a donation on. Here’s our collection of donation receipt templates. Nonprofits and charitable organizations use these to acknowledge and record contributions from donors. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. (click image to download in word format) Web by using a free printable. The cash donation receipt assists in proving the authenticity of the transaction to the government should the donor wish to deduct the contribution from their total income. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Primarily, the receipt is used by organizations for. If you are responsible for creating a document like this for your organization, these charitable donation receipt templates make it easy to acknowledge gifts from your donors in a variety of situations. The charity organization that receives the donation should provide a receipt with their details included. Here’s our collection of donation receipt templates. Primarily, the receipt is used by. Here’s our collection of donation receipt templates. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. These are given when a donor donates to a nonprofit organization. A donation can be in the form of cash or property. Web a donation receipt provides. Feel free to download, modify and use any you like. For more templates, refer to our main receipt templates page here. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. One requirement is that you give donors a donation receipt, also known as a. Web use this area to write in a brief summary of items donated & the number of boxes and bags. Online donation receipts template canada. These free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. What to include in a donation receipt. Primarily, the receipt is. Web the 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the agi limit of 60% for cash donations for qualified charities. Web this donations receipt template provides official documentation and information regarding the gift or money made by a donor. What is a donation receipt? A donation receipt. Web updated november 14, 2023. Web by using a free printable donation receipt template, you can save time and ensure that all necessary information is included, such as the donor’s name, the amount donated, and the date of the contribution. If you are responsible for creating a document like this for your organization, these charitable donation receipt templates make it. Instead of creating from scratch, you can get and use these donation receipt templates for free. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Instead of creating from scratch, you can get and use these donation receipt templates for free. Web updated november 14, 2023. What to include in a donation receipt. Web the 2023 and 2024 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the agi limit of 60% for cash donations for qualified charities. For more templates, refer to our main receipt templates page here. Online donation receipts template canada. The charity organization that receives the donation should provide a receipt with their details included. Web 50+ free donation receipt templates (word | pdf) when accepting donations, there are various requirements that your organization needs to meet in order to be compliant with the rules of your area. What is a donation receipt? Web charitable donation receipt templates provide a practical and efficient way to generate accurate receipts that acknowledge and record donations. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. If you’re using sumac nonprofit crm, you can setup your receipts to send automatically after someone makes a donation on your website. It is typically provided by the organization that received the donation and serves as proof of the donation for tax purposes.

50+ FREE Donation Receipt Templates (Word PDF)

Free Printable Donation Receipt Template

FREE 20+ Donation Receipt Templates in PDF Google Docs Google

Printable Donation Receipt Letter Template

![501c3 Donation Receipt Template Printable [Pdf & Word]](https://templatediy.com/wp-content/uploads/2022/03/501c3-Donation-Receipt-PDF.jpg)

501c3 Donation Receipt Template Printable [Pdf & Word]

Donation Receipt Template in Microsoft Word

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

Donation Receipt Template download free documents for PDF, Word and Excel

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-10.jpg)

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-27.jpg)

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Web By Using A Free Printable Donation Receipt Template, You Can Save Time And Ensure That All Necessary Information Is Included, Such As The Donor’s Name, The Amount Donated, And The Date Of The Contribution.

One Requirement Is That You Give Donors A Donation Receipt, Also Known As A 501 (C) (3).

The Cash Donation Receipt Assists In Proving The Authenticity Of The Transaction To The Government Should The Donor Wish To Deduct The Contribution From Their Total Income.

Web Use This Area To Write In A Brief Summary Of Items Donated & The Number Of Boxes And Bags.

Related Post: