Printable 2290 Form

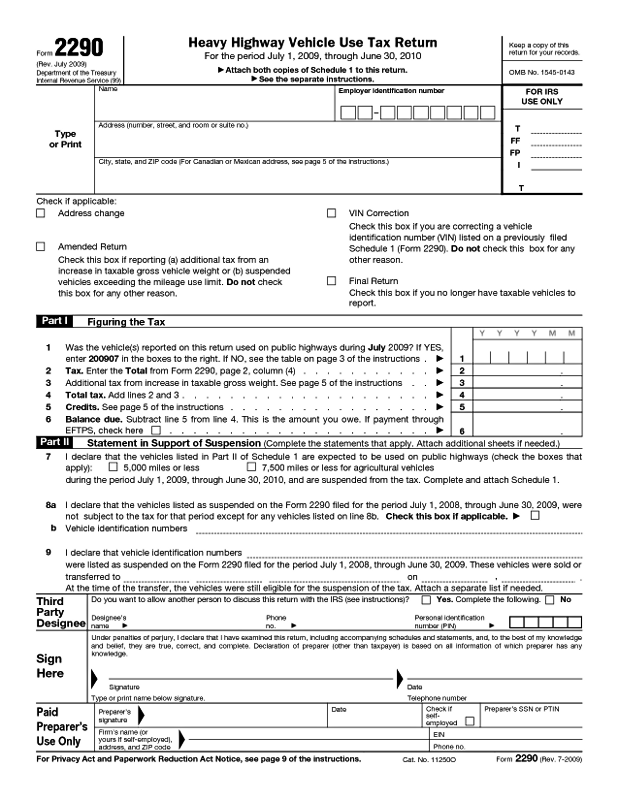

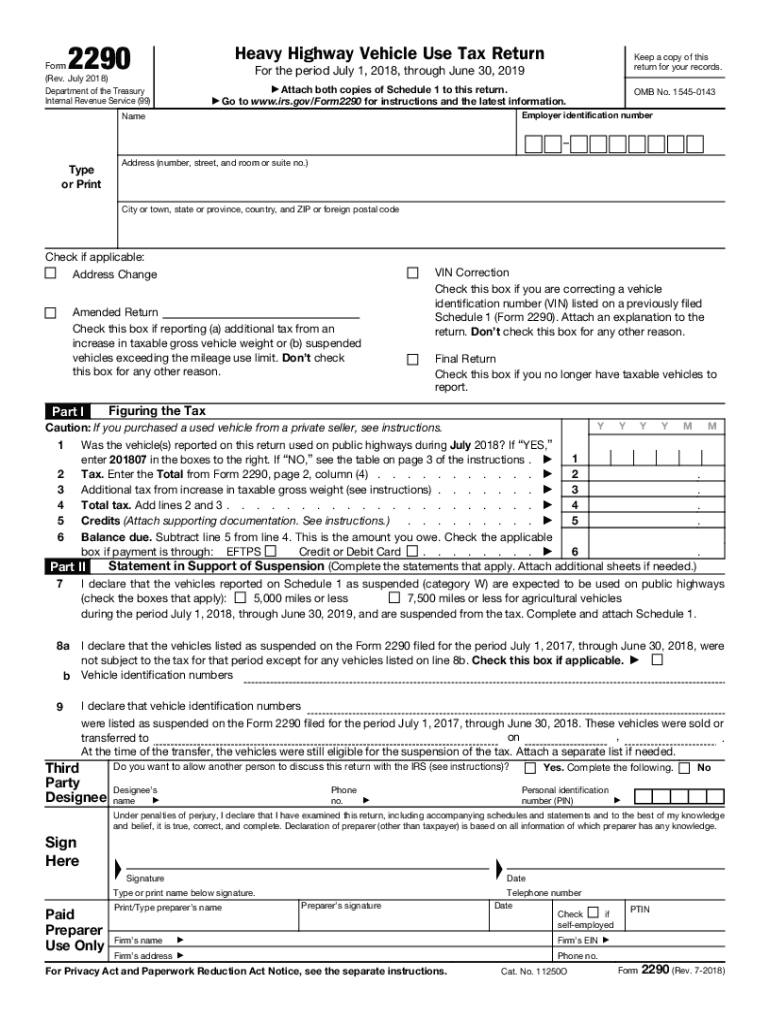

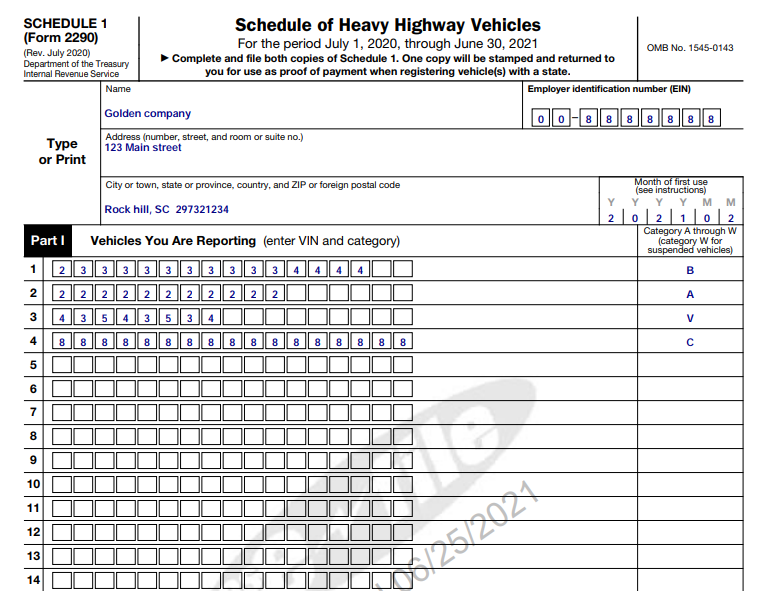

Printable 2290 Form - This july 2022 revision is for the tax period beginning on july 1, 2022, and ending on june 30, 2023. Web if you own and operate a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more, then you must file road tax form 2290 and pay the heavy vehicle use tax, failure to which leads to irs penalties. This july 2021 revision is for the tax period beginning on july 1, 2021, and ending on june 30, 2022. July 2019) department of the treasury internal revenue service (99) heavy highway vehicle use tax return for the period july 1, 2019, through june 30, 2020 attach both copies of schedule 1 to this return. Browse 11 form 2290 templates collected for any of your needs. Web the irs form 2290 is due on august 31st each year for vehicles used on a public highway during the month of july. The purpose of the tax is to help fund the construction and maintenance of the nation's public highway system. Filing online is simple, fast & secure. Web form 2290 is a crucial requirement for owners and operators of heavy vehicles to fulfill their heavy highway vehicle use tax obligations. Go to www.irs.gov/form2290 for instructions and the latest information. Schedule of heavy highway vehicles. Keep a copy of this return for your records. • figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 This july 2021 revision is for the tax period beginning on july 1, 2021, and ending on june 30, 2022. Web use form 2290. Once you are logged in, you will be able to download and print the watermarked schedule 1 document for any previously filed 2290 returns on your account. If you have not yet filed, it's time to get started! Web the irs form 2290 is due on august 31st each year for vehicles used on a public highway during the month. Web download form 2290 for current and previous years. The purpose of the tax is to help fund the construction and maintenance of the nation's public highway system. Web the easiest way to get a copy of your paid 2290 if you have misplaced the stamped schedule 1 that was sent via email, is to log into your account. Browse. Web use form 2290 for the following actions. July 2020) departrnent of the treasury internal revenue service name schedule of heavy highway vehicles for the period july 1, 2020, through june 30, 2021 complete and file both copies of schedule 1. Please review the information below. Form 2290 is used to figure and pay the tax due on certain heavy. Web if you own and operate a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more, then you must file road tax form 2290 and pay the heavy vehicle use tax, failure to which leads to irs penalties. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1,. Web schedule 1 (form 2290) (rev. Fill out the heavy highway vehicle use tax return online and print it out for free. Go to www.irs.gov/form2290 for instructions and the latest information. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable highway motor. The form, instructions, or publication you are looking for begins after this coversheet. Web the irs form 2290 is due on august 31st each year for vehicles used on a public highway during the month of july. For the period july 1, 2022, through june 30, 2023. Web you must file form 2290 and schedule 1 for the tax period. If you have not yet filed, it's time to get started! Web download form 2290 for current and previous years. Web the form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. Filing this form is important for heavy vehicle owners and helps ensure that. Web form 2290 is a crucial. If you have not yet filed, it's time to get started! Web heavy highway vehicle use tax return. Web the form 2290 is a tax form used to calculate and report the excise tax owed on highway motor vehicles. Attach both copies of schedule 1 to this return. The form, instructions, or publication you are looking for begins after this. Browse 11 form 2290 templates collected for any of your needs. Filing this form is important for heavy vehicle owners and helps ensure that. The purpose of the tax is to help fund the construction and maintenance of the nation's public highway system. Once you are logged in, you will be able to download and print the watermarked schedule 1. Fill out the heavy highway vehicle use tax return online and print it out for free. July 2019) department of the treasury internal revenue service (99) heavy highway vehicle use tax return for the period july 1, 2019, through june 30, 2020 attach both copies of schedule 1 to this return. Web if you own and operate a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more, then you must file road tax form 2290 and pay the heavy vehicle use tax, failure to which leads to irs penalties. July 2022) department of the treasury. Filing this form is important for heavy vehicle owners and helps ensure that. • figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 Web schedule 1 (form 2290) (rev. Web form 2290 is a crucial requirement for owners and operators of heavy vehicles to fulfill their heavy highway vehicle use tax obligations. Web the irs form 2290 is due on august 31st each year for vehicles used on a public highway during the month of july. July 2020) departrnent of the treasury internal revenue service name schedule of heavy highway vehicles for the period july 1, 2020, through june 30, 2021 complete and file both copies of schedule 1. This july 2022 revision is for the tax period beginning on july 1, 2022, and ending on june 30, 2023. Go to www.irs.gov/form2290 for instructions and the latest information. For the period july 1, 2019, through june 30, 2020. Attach both copies of schedule 1 to this return. For the period july 1, 2022, through june 30, 2023. Keep a copy of this return for your records.

Irs 2290 Form 2021 Printable Customize and Print

2290 Form Printable

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

2022 Form 2290 Printable IRS 2290 Tax Form & Instructions for Online

Irs 2290 Form 2021 Printable Customize and Print

Printable 2290 Form Customize and Print

Irs Gov 2290 20182024 Form Fill Out and Sign Printable PDF Template

IRS Form 2290 Printable for 202324 Download 2290 for 14.90

File IRS 2290 Form Online for 20232024 Tax Period

Free Printable Form 2290 Printable Templates

Filing Online Is Simple, Fast & Secure.

Web You Must File Form 2290 And Schedule 1 For The Tax Period Beginning On July 1, 2024, And Ending On June 30, 2025, If A Taxable Highway Motor Vehicle (Defined Later) Is Registered, Or Required To Be Registered, In Your Name Under State, District Of Columbia, Canadian, Or Mexican Law At The Time Of Its First Use During The Tax Period And The.

Please Review The Information Below.

Web Information About Form 2290, Heavy Highway Vehicle Use Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

Related Post: