Living Trust Forms Free Printable

Living Trust Forms Free Printable - Size 12 to 16 pages. This is a trust that you have established during your lifetime in which you place your properties and assets within the trust for estate and asset planning. The purpose of this trust is. The term “revocable” means that a living trust can be amended or revoked at any given time by the. The most common reason for creating a trust is to manage and distribute your assets, but you can include any other lawful reason you choose. Web types of living trust forms. Web a living trust is a legal form that places your assets into a legal entity (a trust) to then be easily distributed to your heirs at the time of your death. The trust’s assets will be transferred to the beneficiaries upon the grantor’s death. A living trust is a legal document that allows an individual (grantor) to place assets under the management of a trustee, who can be the grantor or another party. It provides for payments of income for the grantor and the distribution of the remaining assets of the trust upon their death. Size 12 to 16 pages. You use living trust forms to prepare your assets and estate. Create a revocable living trust document. There are two types of living trusts:. Web revocable living trust, to be known as “the _____ [grantor] revocable living trust” (this “trust”). There are two types of living trusts:. The purpose of this trust is. Web updated may 09, 2024. Then you would assign a person to manage assets for your beneficiaries, while you’re still alive. A living trust, also known as a revocable trust, is an agreement created by a person, known as the grantor, to hold some portion of their. It provides for payments of income for the grantor and the distribution of the remaining assets of the trust upon their death. Fill out the name and address of the person (or people) putting property into the trust. Web types of living trust forms. Web how to set up a revocable living trust. Web a living trust is a trust. Indicate the purpose of the trust. The trust’s assets will be transferred to the beneficiaries upon the grantor’s death. Size 12 to 16 pages. Web a living trust is a legal form that places your assets into a legal entity (a trust) to then be easily distributed to your heirs at the time of your death. To set up a. Create a revocable living trust document. The trustee is responsible for safeguarding the trust’s assets during the grantor’s lifetime. Fill out the grantor information. Web types of living trust forms. Web a living trust is a trust created by a person (the grantor) for use during that person's lifetime. Web a living trust form is an official document used by an individual (grantor) to transfer the benefits generated by or from their assets to another person (beneficiary) in the event that they pass away or become incapacitated. A living trust is a legal document that allows an individual (grantor) to place assets under the management of a trustee, who. Web a living trust form is an official document used by an individual (grantor) to transfer the benefits generated by or from their assets to another person (beneficiary) in the event that they pass away or become incapacitated. Fill out the grantor information. You use living trust forms to prepare your assets and estate. Within it, you must name a. Web how to set up a revocable living trust. Web living trust agreement. Web types of living trust forms. Sign the document and get it notarized. Then you would assign a person to manage assets for your beneficiaries, while you’re still alive. The trustee is responsible for safeguarding the trust’s assets during the grantor’s lifetime. Fill out the grantor information. It also includes an option which allows the grantor to amend or revoke the trust at any time. Web how to set up a revocable living trust. Sign the document and get it notarized. Web a living trust form is an official document used by an individual (grantor) to transfer the benefits generated by or from their assets to another person (beneficiary) in the event that they pass away or become incapacitated. To set up a revocable living trust, follow these steps: Then you would assign a person to manage assets for your beneficiaries,. Web how to set up a revocable living trust. It also includes an option which allows the grantor to amend or revoke the trust at any time. Part iii purpose of trust. The term “revocable” means that a living trust can be amended or revoked at any given time by the. Web types of living trust forms. Web updated may 09, 2024. The trustee is responsible for safeguarding the trust’s assets during the grantor’s lifetime. Sign the document and get it notarized. Web revocable living trust, to be known as “the _____ [grantor] revocable living trust” (this “trust”). Web a living trust is a legal form that places your assets into a legal entity (a trust) to then be easily distributed to your heirs at the time of your death. To set up a revocable living trust, follow these steps: This is a trust that you have established during your lifetime in which you place your properties and assets within the trust for estate and asset planning. Create a revocable living trust document. Fill out the grantor information. The purpose of this trust is. It becomes effective soon after the grantor passes on without being subjected to the probate process in court, as in the case of a.![7+ Living Trust Forms Template EDITABLE Free [Word, PDF, Doc]](https://www.opensourcetext.org/wp-content/uploads/2021/07/1-1-768x709.png)

7+ Living Trust Forms Template EDITABLE Free [Word, PDF, Doc]

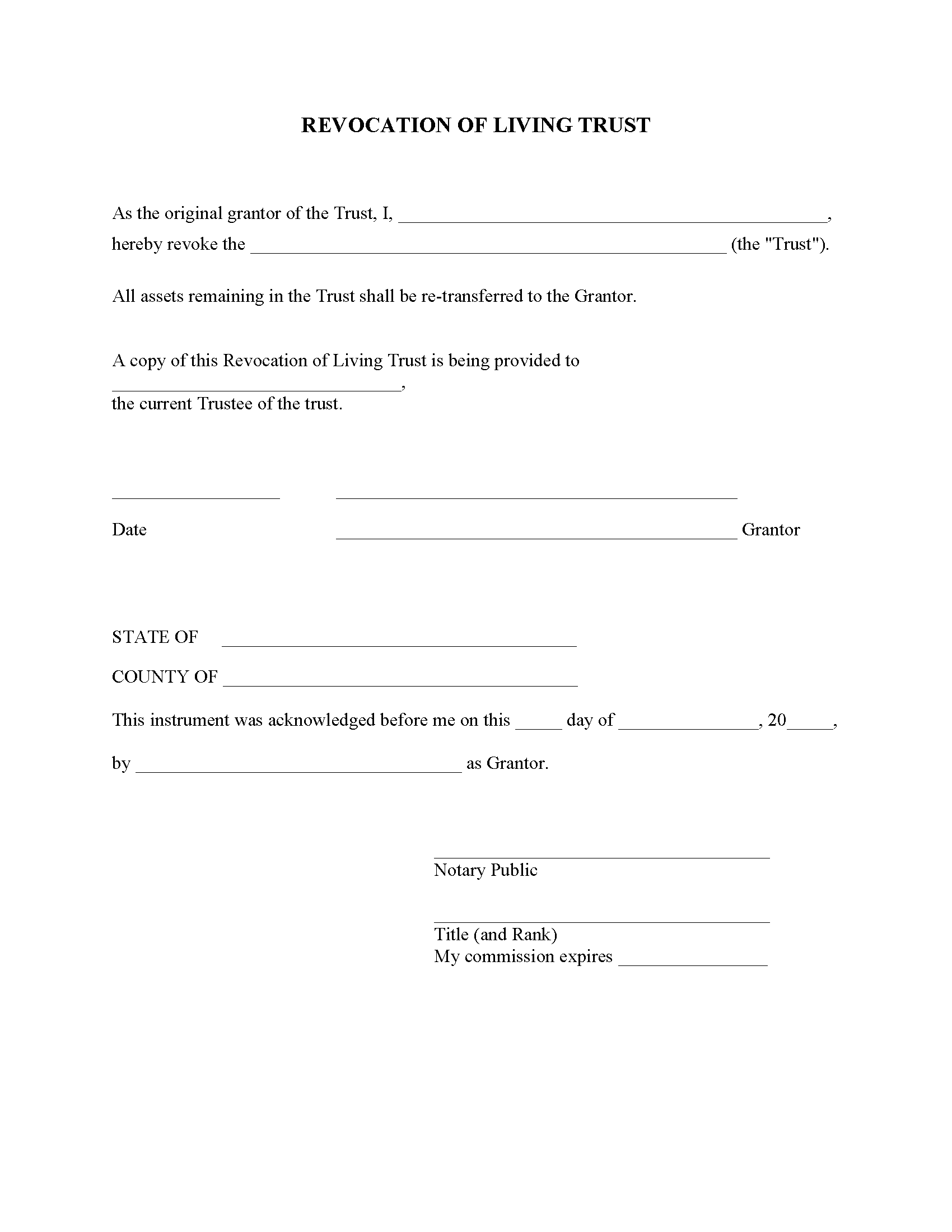

Revocation of Living Trust Form Free Printable Legal Forms

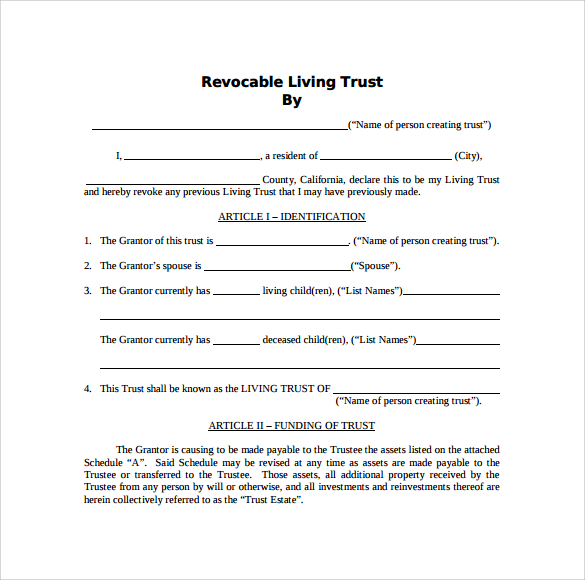

15 new Printable Living Trust Templates Printable Templates

Free Printable Living Trust Form (GENERIC)

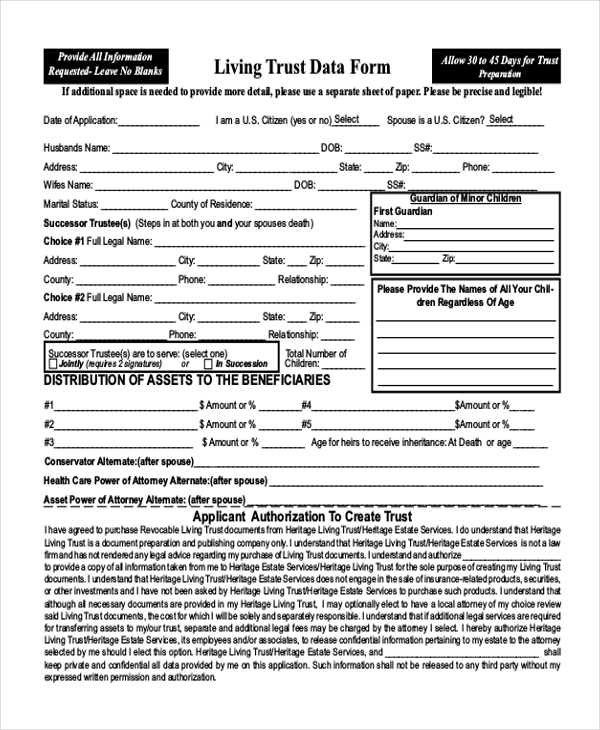

FREE 10+ Sample Living Trust Form Templates in PDF Word

Free Printable Living Trust Form (GENERIC)

![30 Free Living Trust Forms & Templates [Word] TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/12/living-trust-form-04.jpg)

30 Free Living Trust Forms & Templates [Word] TemplateArchive

![30 Free Living Trust Forms & Templates [Word] TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/12/living-trust-form-02.jpg)

30 Free Living Trust Forms & Templates [Word] TemplateArchive

![30 Free Living Trust Forms & Templates [Word] TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/12/living-trust-form-20.jpg)

30 Free Living Trust Forms & Templates [Word] TemplateArchive

FREE 8+ Sample Living Trust Forms in PDF MS Word

You Use Living Trust Forms To Prepare Your Assets And Estate.

A Living Trust Is A Legal Document That Allows An Individual (Grantor) To Place Assets Under The Management Of A Trustee, Who Can Be The Grantor Or Another Party.

Web A Living Trust Is A Trust Created By A Person (The Grantor) For Use During That Person's Lifetime.

The Grantor Has, Or Upon The Execution Of This Trust Immediately Will, Transfer The Assets Listed In Schedule A Hereto As A Gift And Without Consideration.

Related Post: