Form 4070 Printable

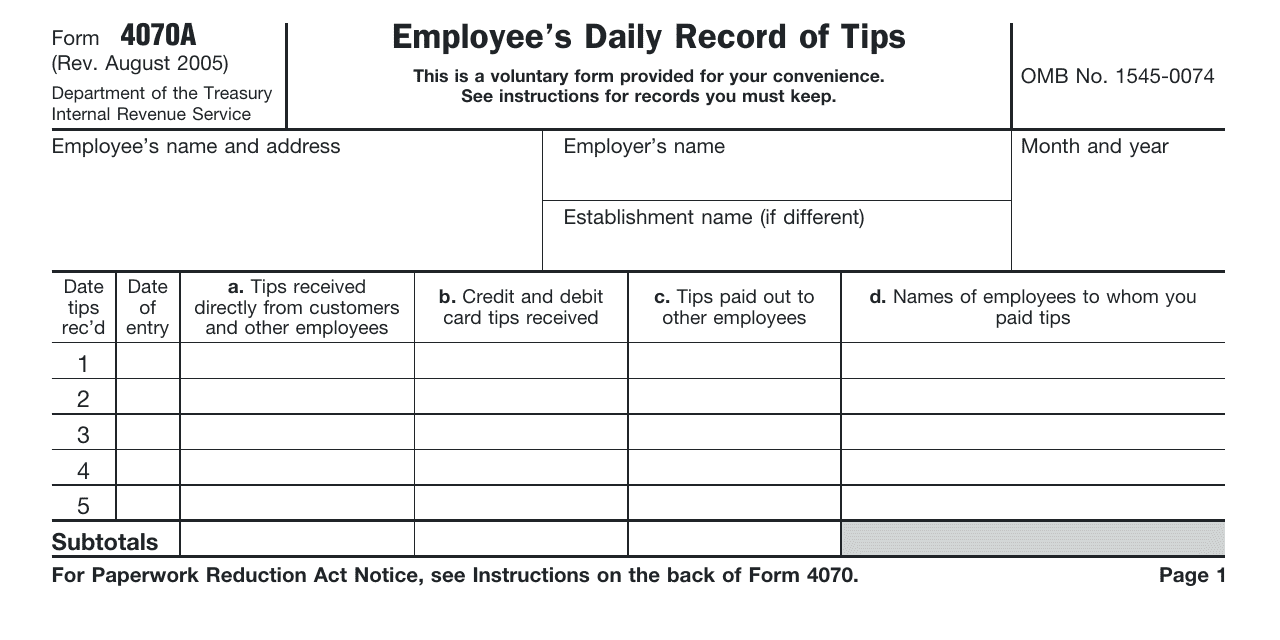

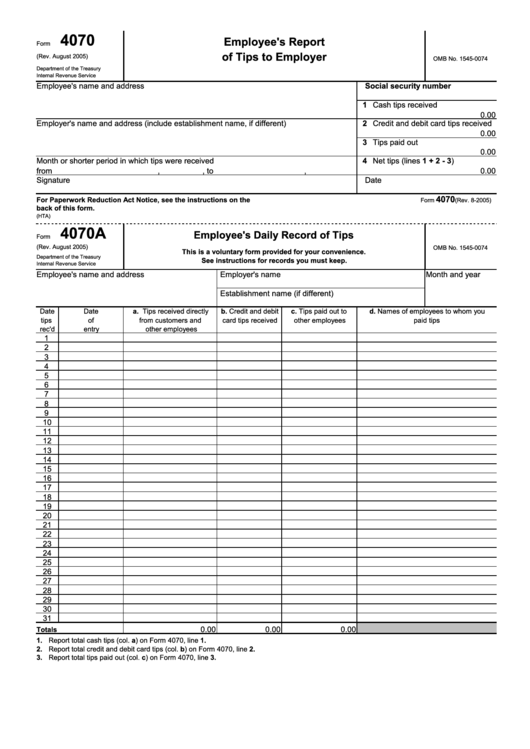

Form 4070 Printable - Employee’s daily record of tips. How to use form 4070 to report tips to your employer; Restaurant owners are required by law to withhold payroll taxes on employee tips. Web form 4070, the employee’s report of tips to employer, is a tax document provided by the irs. Web form 4070, employee’s report of tips to employer. Your legal name, permanent address and social security number. You can use form 4070a, employee's daily record of tips, included in publication 1244, employee's daily record of tips and report of tips to employer. This is a voluntary form provided for your convenience. It is specifically designed for employees in the service industry who receive tips as part of their income. Web in this article, we’ll walk through this tax form, including: Web keep a daily tip record. If you are not using form 4070, you’ll need to include the following on your daily log: This form allows employees to keep track of tips received on a daily basis. Employee’s daily record of tips. Web in this article, we’ll walk through this tax form, including: Let’s start with a comprehensive view of the tax form itself. This includes cash tips, tips you receive from other employees, and debit and credit card tips. You can use form 4070a, employee's daily record of tips, included in publication 1244, employee's daily record of tips and report of tips to employer. You must report tips every month. If you. Report your tips to your employer on form 4070 or your own daily tip log. The information on this form tells the employer how much tax to. Restaurant owners are required by law to withhold payroll taxes on employee tips. Alternatives to using irs form 4070 to keep track of tips; This is a voluntary form provided for your convenience. These include cash tips, tips received from other employees, and debit and credit card tips. Employee’s daily record of tips. Let’s start with a comprehensive view of the tax form itself. Web form 4070, employee’s report of tips to employer. Your legal name, permanent address and social security number. Web keep a daily tip record. This is a voluntary form provided for your convenience. Web form 4070, the employee’s report of tips to employer, is a tax document provided by the irs. These include cash tips, tips received from other employees, and debit and credit card tips. Employees use this form to report received tips to their employer. These include cash tips, tips received from other employees, and debit and credit card tips. Use this form to report tips you receive to your employer. See instructions for records you must keep. Web in this article, we’ll walk through this tax form, including: Frequently asked questions about reporting tip income; Report your tips to your employer on form 4070 or your own daily tip log. Employees must keep a daily record of tips received. Web form 4070, the employee’s report of tips to employer, is a tax document provided by the irs. This includes cash tips, tips you receive from other employees, and debit and credit card tips. This form. This form allows employees to keep track of tips received on a daily basis. Let’s start with a comprehensive view of the tax form itself. Employee’s daily record of tips. The information on this form tells the employer how much tax to. This includes cash tips, tips you receive from other employees, and debit and credit card tips. This form allows employees to keep track of tips received on a daily basis. These include cash tips, tips received from other employees, and debit and credit card tips. If you are not using form 4070, you’ll need to include the following on your daily log: Use this form to report tips you receive to your employer. Employee’s daily record. Web use this form to report tips you receive to your employer. Web how to file form 4070. Employees use this form to report received tips to their employer. You must report tips with your regular wages on your tax return. If you are not using form 4070, you’ll need to include the following on your daily log: Web keep a daily tip record. Employees use this form to report received tips to their employer. Employees must keep a daily record of tips received. See instructions for records you must keep. Report your tips to your employer on form 4070 or your own daily tip log. Web use this form to report tips you receive to your employer. You can use form 4070a, employee's daily record of tips, included in publication 1244, employee's daily record of tips and report of tips to employer. Use this form to report tips you receive to your employer. Frequently asked questions about reporting tip income; If you are not using form 4070, you’ll need to include the following on your daily log: You must report tips every month. This includes cash tips, tips you receive from other employees, and debit and credit card tips. It is specifically designed for employees in the service industry who receive tips as part of their income. Restaurant owners are required by law to withhold payroll taxes on employee tips. This includes cash tips, tips you receive from other employees, and debit and credit card tips. How to use form 4070 to report tips to your employer;

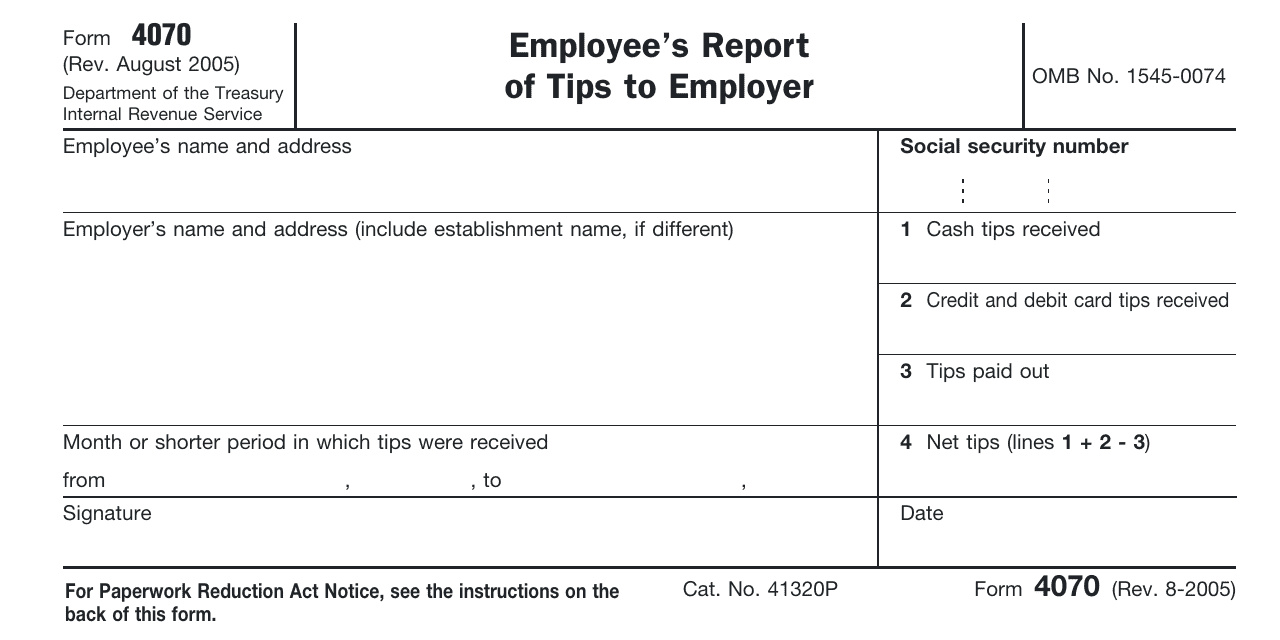

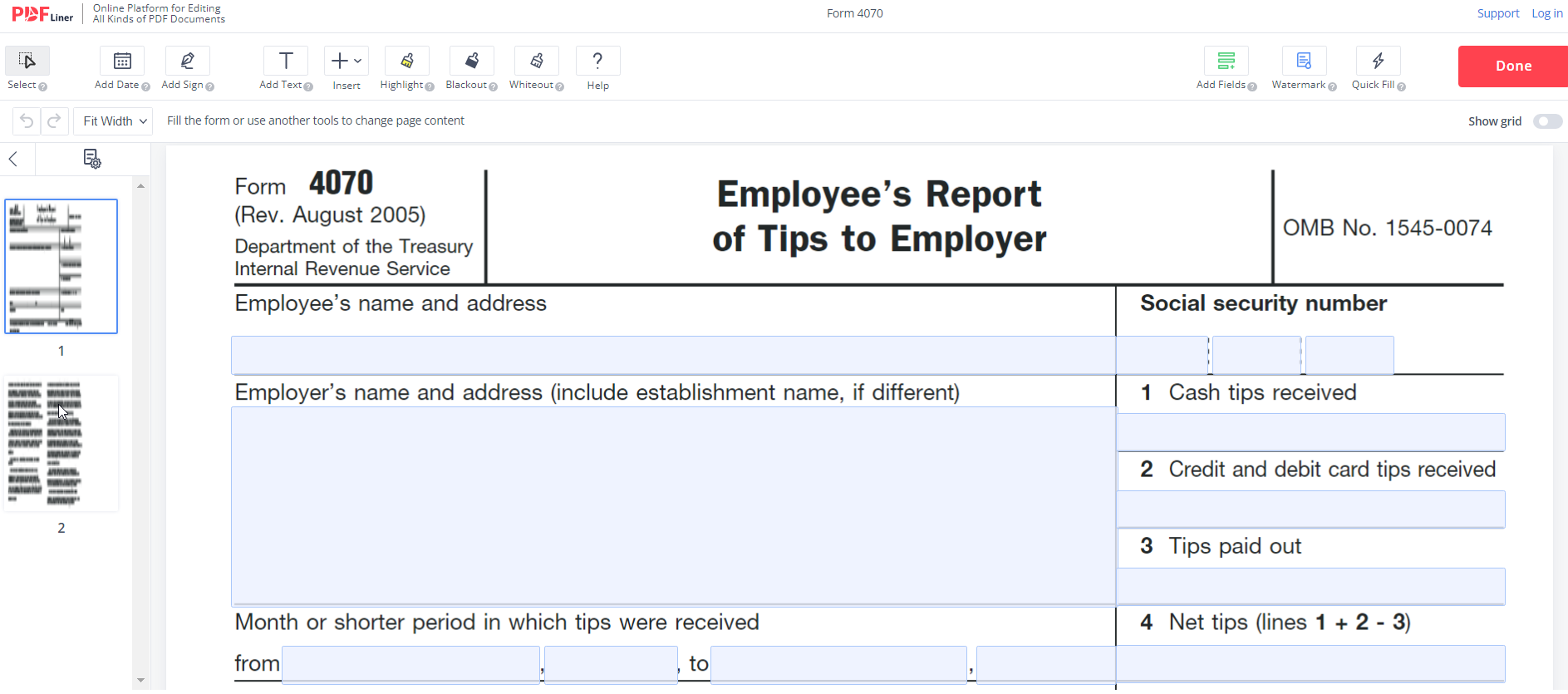

IRS Form 4070 Download Fillable PDF, Employee's Report of Tips to

20052024 Form IRS 4070 Fill Online, Printable, Fillable, Blank pdfFiller

Form 4070 Employee's Report Of Tips To Employer printable pdf download

Top 6 Form 4070 Templates free to download in PDF, Word and Excel formats

Irs Form 4070 Fillable Printable Forms Free Online

Irs Form 4070a Printable Printable Forms Free Online vrogue.co

How to Fill Out Form 4070 for Seamless Tip Reporting

Irs Form 4070 Fillable Printable Forms Free Online

Irs Form 4070a Printable

Irs Form 4070 Fillable Printable Forms Free Online

Let’s Start With A Comprehensive View Of The Tax Form Itself.

August 2005) Department Of The Treasury Internal Revenue Service.

Your Legal Name, Permanent Address And Social Security Number.

This Form Allows Employees To Keep Track Of Tips Received On A Daily Basis.

Related Post: